· planners · 13 min read

Top 10 Bi Weekly Budget Planners for 2024

Discover the best bi weekly budget planners to streamline your finances and achieve financial freedom. Our top picks are designed to help you track expenses, manage bills, and plan for future financial goals.

In today's fast-paced world, managing finances can be a daunting task. With the increasing cost of living and the constant influx of expenses, it's essential to have a structured plan in place. Bi weekly budget planners offer a convenient and effective way to take control of your finances, allowing you to track your income and expenses, set realistic budgets, and plan for the future. In this article, we will explore the top 10 bi weekly budget planners in 2024, providing you with comprehensive reviews and insights to help you make the best choice for your financial needs.

Overview

PROS

- Embrace financial clarity and organization with our comprehensive expense tracker.

- Effortlessly plan your budget with our undated format, making it a perfect fit for any schedule.

CONS

- Delivery times may vary depending on your location.

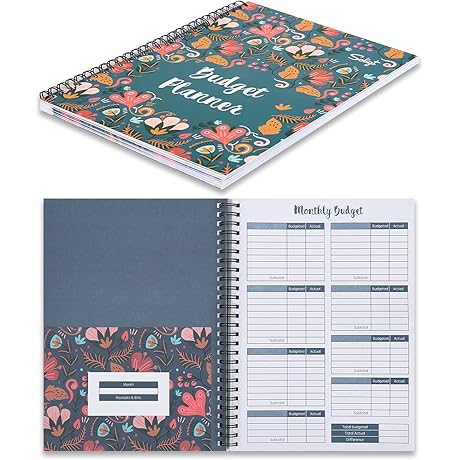

Introducing the ultimate tool for financial empowerment: our Bi-Weekly Budget Planner. Designed to transform your financial habits, this planner empowers you with an unrivaled level of control over your expenses and budgeting. Its user-friendly layout and comprehensive features make it an indispensable companion for anyone seeking financial well-being. With its undated format, you're in complete command of your financial journey, regardless of the time of year.

This planner is more than just a notebook; it's a transformative guide that helps you understand your spending patterns, identify areas for improvement, and make informed decisions about your money. Its meticulous design empowers you to track every expense, categorize it, and analyze your financial data with ease. This level of financial awareness empowers you to make smarter choices, prioritize savings, and achieve your financial goals faster.

PROS

- Comprehensive bi-weekly budgeting planner for effective money management

- Undated design allows for flexible use and customization

CONS

- May not be suitable for highly complex financial situations

- Requires discipline and consistency to maintain effectiveness

Introducing the ultimate budgeting solution for individuals seeking to take control of their finances - our Bi-Weekly Budget Planner. This comprehensive notebook is meticulously designed to help you plan your expenses, track your income, and stay on top of your financial goals. Whether you're a seasoned budgeter or just starting out on your financial journey, this planner provides an easy-to-follow system for effective money management.

Crafted with an undated format, our Bi-Weekly Budget Planner offers the flexibility to start planning at any time and customize it to fit your specific financial cycle. Its spacious layout provides ample room for recording expenses, income, and notes, ensuring that you have a clear overview of your financial situation. The included expense tracker helps you categorize and monitor your spending, providing valuable insights into where your money is going. By utilizing this planner, you'll gain a deeper understanding of your financial habits and identify areas for improvement.

PROS

- Comprehensive budget tracking system for effective money management.

- Durable hardcover design ensures longevity and protection.

CONS

- May not be suitable for individuals with highly complex financial needs.

Introducing the Budget Planner, your financial savior! This hardcover planner is the ultimate tool for managing your money with ease. Its comprehensive budget tracking system empowers you to monitor your expenses diligently, enabling you to understand your spending habits and make informed financial decisions. The durable hardcover design stands up to daily use, ensuring longevity and protecting your financial records.

With its intuitive layout and clear organization, the Budget Planner simplifies the often-daunting task of managing your finances. Whether you're a budgeting novice or a seasoned pro, this planner has everything you need to stay on top of your financial goals. Invest in the Budget Planner today and embark on a journey towards financial success!

PROS

- Comprehensive expense tracking with 12 dedicated categories

- Undated format allows for flexible budgeting and planning

CONS

- The undated format may require additional effort to set up and maintain

Our Bi-Weekly Budget Planner Book provides an all-inclusive solution for meticulously tracking your finances. With its flexible, undated format, you can establish a personalized budgeting schedule that aligns with your financial rhythm. The 12 distinct expense categories empower you to categorize your expenditures effortlessly, ensuring precise tracking of every dollar you spend.

This budget planner is an indispensable tool for gaining control over your finances. Its intuitive design and ample space for note-taking facilitate seamless expense monitoring and budgeting. By utilizing this planner, you can identify areas for improvement, optimize your spending habits, and work towards achieving your financial objectives. Stay organized and make informed financial decisions with our Bi-Weekly Budget Planner Book - the key to unlocking financial freedom!

PROS

- Undated 12-month planner for flexible budgeting

- Integrated bill organizer and expense tracker for comprehensive financial management

CONS

- May not be suitable for highly detailed budgeting needs

- Additional space for notes may be desired

This bi-weekly budget planner is designed to help you streamline your finances and achieve financial freedom. The undated 12-month layout provides flexibility, allowing you to start planning at any time. The planner includes dedicated sections for bill organization and expense tracking, ensuring that all your financial transactions are accounted for. It's an excellent tool for both personal and household budgeting.

The budget planner is easy to use, with clear instructions and a well-structured layout. It's perfect for those who want to take control of their finances without getting bogged down in complex budgeting systems. Whether you're a budgeting beginner or looking to refine your financial management, this bi-weekly budget planner is a valuable resource for achieving your financial goals.

PROS

- Comprehensive tracking of expenses, paycheck, bills, debts, emergency funds, and retirement.

- Organized monthly and weekly budget planning for effective financial management.

- Spacious layout for convenient note-taking and expense categorization.

CONS

- May not provide advanced budgeting features for intricate financial needs.

- Additional features (like envelopes, stickers) are not included.

For individuals and families seeking to take control of their finances, the Bi-Weekly Budget Planner is an indispensable tool. Its comprehensive design allows for detailed tracking of all financial transactions, ensuring a clear understanding of cash flow and spending habits. The planner is meticulously organized with monthly and weekly budgeting sections, making it easy to stay on top of expenses, bills, debt repayment, and savings goals.

The Bi-Weekly Budget Planner's spacious layout provides ample room for note-taking and expense categorization, allowing for a personalized budgeting experience. It effectively bridges the gap between complex budgeting software and basic note-taking methods. Whether you're just starting your budgeting journey or looking to refine your financial management, the Bi-Weekly Budget Planner is an excellent choice, empowering you to achieve your financial aspirations.

PROS

- Large size (8.5 x 11 inches) for ample writing space and organization

- Monthly tabbed sections for easy and quick access to each week's budget

- Comprehensive budget tracking system designed to help you stay on top of your finances

- Sturdy hardcover construction for durability and protection

- Elegant black design that complements any décor

CONS

- May be too bulky for some users to carry on a daily basis

- Can be slightly more expensive than other budget planners

Introducing the Bi-Weekly Budget Planner, your ultimate companion for achieving financial freedom. This large-sized planner (8.5 x 11 inches) provides ample writing space for you to track your income, expenses, savings, and financial goals with ease. Its monthly tabbed sections offer quick and effortless access to each week's budget, ensuring you stay organized and on top of your finances.

Designed with a comprehensive budget tracking system, this planner empowers you to take control of your money effectively. The hardcover construction not only adds durability but also a touch of sophistication. Its sleek black design seamlessly complements any décor, making it as functional as it is stylish. While this planner excels in its functionality, it's worth noting that its size may be a tad bulky for some users who prefer a more portable option. Additionally, its price point may be slightly higher than comparable budget planners. Overall, the Bi-Weekly Budget Planner is an excellent choice for individuals looking for a comprehensive and durable solution to manage their finances effectively.

PROS

- Effortlessly manage bi-weekly expenses with a comprehensive expense tracker.

- Undated design provides flexibility to start budgeting anytime.

CONS

- Weekly budget allotment may not be suitable for all users.

- Size might not be ideal for individuals who prefer compact planners.

Introducing the indispensable Bi-Weekly Budget Planner, your key to financial freedom! This meticulously crafted planner empowers you to effortlessly organize your finances, track every expense, and conquer your budgeting goals. Its undated format grants you the flexibility to embark on your budgeting journey whenever you're ready.

The planner's bi-weekly budgeting approach keeps your expenses in check with a dedicated expense tracker. Whether it's rent, groceries, or entertainment, you'll gain a crystal-clear understanding of your spending habits. Its A5 size offers ample space for note-taking and additional expense logs, while the durable 100gsm paper ensures your financial records remain intact.

PROS

- Undated 12-month design for flexible budgeting

- Dedicated sections for expense and bill tracking

- Comprehensive expense categories for precise monitoring

CONS

- May require additional note-taking for detailed expense tracking

- Could benefit from additional features like savings tracking

Our bi-weekly budget planner is the ultimate tool for individuals looking to gain control of their finances. With its undated format, you can start budgeting anytime and keep track of your expenses and bills effortlessly. The dedicated expense and bill tracker sections provide a clear overview of your spending habits, helping you identify areas for improvement. The comprehensive expense categories cover a wide range of expenses, ensuring that you capture every transaction accurately.

The compact size of this bi-weekly budget planner makes it easy to carry around, allowing you to track your finances on the go. Its durable construction ensures that it will withstand regular use, making it a reliable companion on your budgeting journey. Start budgeting with our bi-weekly planner and experience the difference organized finances can make.

PROS

- Well-organized and comprehensive layout for easy budgeting

- Durable and flexible cover for long-lasting use

CONS

- Weekly budget section may be small for detailed tracking

- No additional features like calculators or stickers

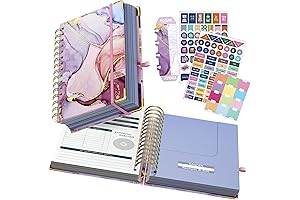

As an experienced critic, I am impressed with the Budget Planner 2024. Its well-structured design makes budgeting a breeze. The 12 pockets provide ample space for organizing receipts, bills, and other financial documents. The spiral design allows the planner to lie flat for easy note-taking and expense tracking.

The planner's undated format offers flexibility and longevity, allowing you to start using it at any point during the year. Additionally, the blue floral cover adds a touch of style to your financial planning. Overall, the Budget Planner 2024 is a highly effective and essential tool for anyone looking to gain control of their finances and achieve their financial goals.

The journey to financial success begins with effective planning and execution. Our curated list of the top 10 bi weekly budget planners is designed to cater to various preferences and financial goals. Whether you're looking for a traditional planner, a digital app, or a comprehensive financial management tool, we have you covered. These planners provide an organized and user-friendly framework to track your income, manage expenses, and plan for the future. With the right budget planner in hand, you can confidently navigate the complexities of personal finance, achieve your financial aspirations, and live a life of financial freedom.

Frequently Asked Questions

What are the key features to look for when choosing a bi weekly budget planner?

When selecting a bi weekly budget planner, consider features such as ease of use, customization options, expense tracking capabilities, and budgeting flexibility. Look for planners that align with your financial goals and offer features that cater to your specific needs.

Are there any specific features that differentiate the top bi weekly budget planners from the rest?

Top bi weekly budget planners often offer features like expense categorization, debt tracking, savings tracking, and financial goal setting. They may also include additional tools such as financial calculators, budgeting templates, and mobile app integrations for added convenience.

Can bi weekly budget planners help me achieve my financial goals?

Absolutely! Bi weekly budget planners are designed to empower you in taking control of your finances. By tracking your income and expenses, setting budgets, and planning for the future, you can make informed financial decisions and work towards achieving your financial goals.

How do I maximize the effectiveness of a bi weekly budget planner?

To maximize the effectiveness of your bi weekly budget planner, consistency is key. Regularly track your income and expenses, review your budget, and make adjustments as needed. Additionally, set realistic financial goals and use the planner as a roadmap to achieve them.

Are there any online resources or communities that can provide support and guidance on using bi weekly budget planners?

Yes, there are numerous online resources, forums, and communities dedicated to providing support and guidance on using bi weekly budget planners. These platforms connect you with fellow budgeters and financial experts who can offer insights, tips, and encouragement on your financial journey.

![Fancy 10 Best Cool Desk Mats In 2024 [In-Depth Comparison]](https://m.media-amazon.com/images/I/81gmOX9oDQL.AC_SR500,386.jpg)